As we approach the end of the year with cases still rising, there seems to be no escape from the adverse economic impact of the pandemic. When domestic economic activities were halted by 75% during ECQ, businesses were pressured to sink or swim while consumers scrambled to get access to the essentials. This shutdown ultimately served as the catalyst for the great migration and acceptance for e-commerce in our country – expanding digital consumer activity even beyond urban areas. This new form of retail, together with the technology that enables it – the digital payment gateways, multiple conversion channels, livestream content, is driving behavioral changes while paving the way for habits to be formed.

But of course even as opportunities arrive, obstacles can arise. One such challenge is that in a dynamic ecosystem composed of laggards as well as early adopters, there’s a need to constantly monitor behavioral shifts as standards and mindsets are still being developed. So how does one sort and sift through these data points to arrive at an actionable plan?

For NUWORKS, real-time data is gathered through search and social listening tools, equipping its strategy and creative team to be able to extract relevant insights. NUWORKS is then able to create distinct and effective eCommerce campaigns and content with highly contextual art, copy and media strategy in an ecosystem where personal relevance drives ad effectiveness.

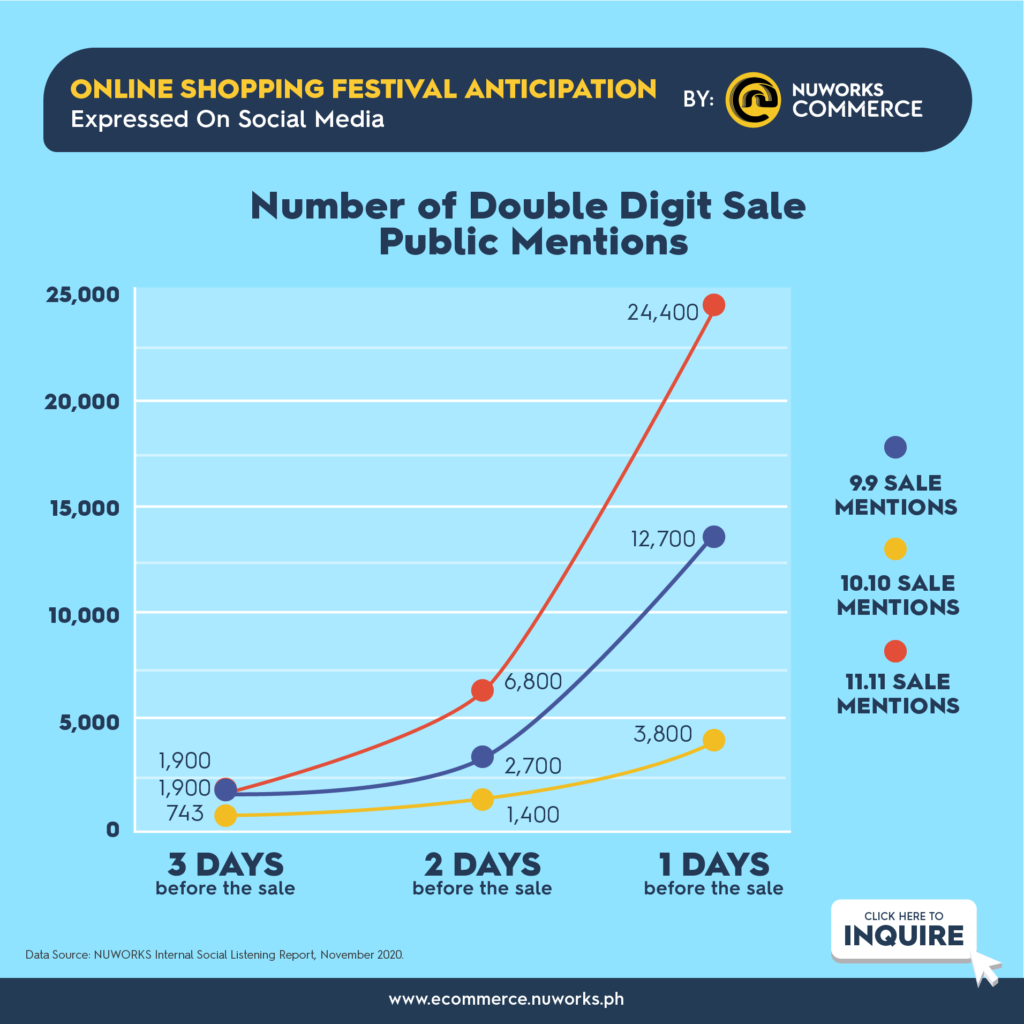

Throughout the eCommerce mega campaigns or “shopping festivals” such as 9.9, 10.10, and 11.11, the agency has been utilizing digital tools to keep up with nuanced consumer behaviors. Coming from the conversations collected by NUWORKS, key eCommerce behaviors across the consumer journey from discovery down to after-sales, have surfaced across the last three “double-double sales”.

Voucher Sharing & Delaying Big Ticket Purchase during Discovery Stage

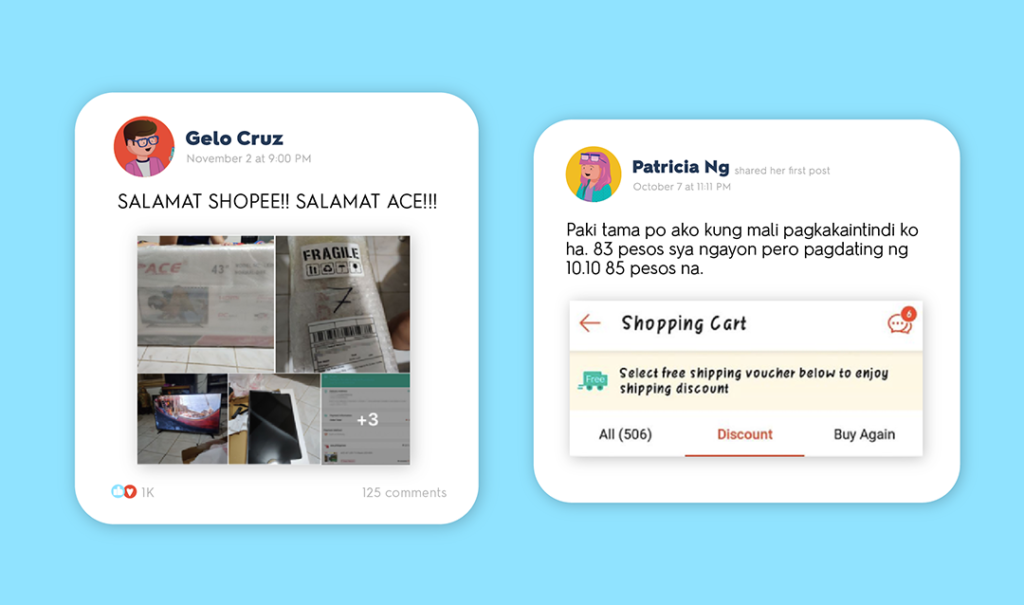

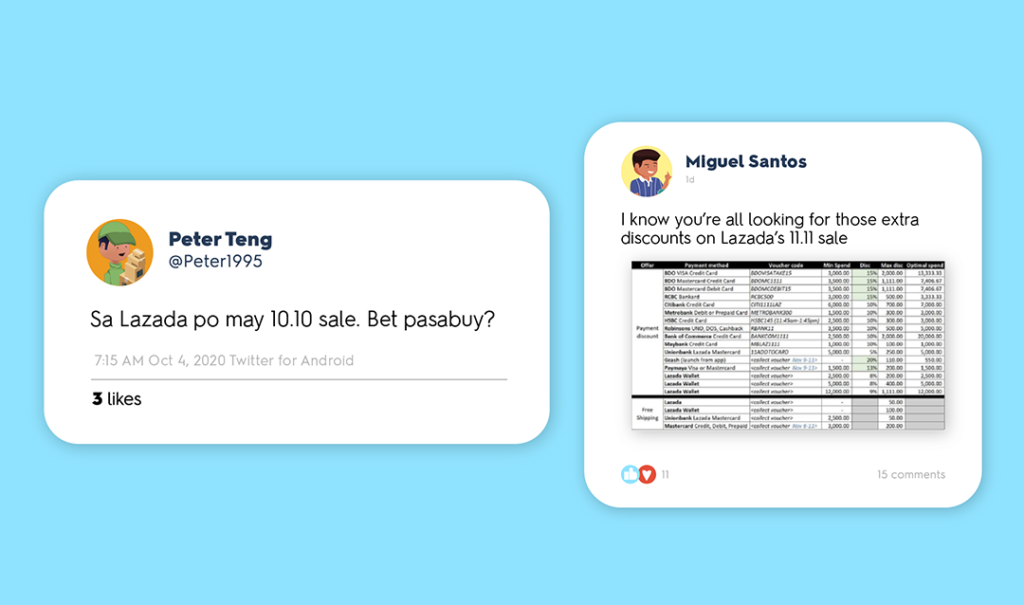

Discounts and price-cuts are almost everywhere during these sale periods, and Pinoys want to make sure they get the lowest price possible. NUWORKS noticed that Pinoy Shoppers tend to hold off the purchase of big-ticket items and schedule the check-out on the day of the monthly double-double sale so they can score bigger deals. Voucher sharing is also prevalent among most eComm shoppers nowadays considering the increase of online groups dedicated to discounts. These vouchers, combined with the behavior to wait out big purchases, guarantees the Pinoy shopper the best deal in every monthly sale.

Be reminded that often in eCommerce, the consumer starts off with their ‘collect then select’ phase during discovery. Your product may be in the cart, but how do you capture and then secure that sweet, sweet checkout? Learn how NUWORKS minimizes the risk of its purchase getting dropped by inquiring on their site.

Crowdsourcing Shopping Ideas and Pre-game Shopping as part of Consideration and Trial

Based on our NUWORKS Engagement Report of the past three double-double sales, shoppers have consistently crowdsourced shopping ideas online to keep them up-to-date with the best deals present, even asking for a peek at their carts. Unlike big ticket customers, some digital consumers treat days leading to major sales as their “pre-game” as they can browse for variety. These Pinoy shoppers are swayed by the promising “pre-11.11 sale” and are likely to check out even before the designated monthly sale. Some even opt for the straight to check-out CTA: ‘Check Out Now’ for the additional discount versus adding to cart.

How can brands then offer value in a way that secures them into the budget that digital consumers earmark for this sale? It may be a matter of motivating the consumer to check out early. Some stores present the best deal upfront and communicate it a week before the mega campaign. Another initiative to consider is investing analytics to help forecast and identify at which points their customer’s inventory runs out — a service available at NUWORKS Commerce.

‘Pasabuy’ and Check-out Hacking during Purchase Stage

Whenever big sale events happen, flexibility finders look for convenient payment and delivery channels and would gravitate towards platforms that give them the most relevant option for their personal situation. They are also prone to create workarounds and other “hacks” when presented with constraints. The popularity of “pasabuys”, or shoppers sharing the shipping fee to be delivered in a single address, as seen during mega sales was an effect of this motivation.

It’s becoming apparent that there’s a diverse set of preferences when it comes to payments. They want debit, credit, and even barter — it’s often hard to figure out what channel will serve best for our Pinoy shoppers and so brands should find the vendors that allow them to offer an omni-channel payment gateway. At the end of the day, removing any and all friction from your consumer to secure that transaction just might be the key difference versus your competitors. You can read more about the building blocks of eCommerce – including payment here.

Consulting eCommunities and Sharing Social Proofs to Secure Loyalty and Advocacy

eCommunities made huge strides to help Pinoy shoppers during this time as well. As buyer behavior now involves a lot of research, NUWORKS noticed the rise of online groups and forums (e.g Lazada Peers PH, eCommerce Millionaires, Shopee Power Sellers, scammers list always update) to help push the Pinoy shopper into making better decisions. The organic “social-proofing” of these communities provide assurance to shoppers and address the emerging worry on sanitation, safety, and security of items online. Aside from becoming a hub for positive and negative reviews, these eCommunities also serve as a repository for like-minded individuals to share relatable online shopping stories without the judgment of their peers.

Every star counts. Applying special attention to your reviews as well as the engagement around your brand can go a long way in securing future transactions, especially with the spotlight on each post and every comment section potentially turning into a minefield. NUWORKS Commerce offers Management & Operations that include customer support on orders, deliveries, and product feedback. The agency can provide dedicated customer service representatives to manage feedback on your eCommerce stores and to leverage on these sentiments to serve as persuasive social proof for the next customer.

Ending the Year with a Shift to More Mindful Spending

In the wake of 11.11, consumers are becoming more cautious with their spending. Sentiments revolving around donating, investing, and saving popped up in particular in the NUWORKS 11.11 scan, suggesting that they may be tempering down from all the double-double hype. These mentions of toning down consumption are manifestations of what Nielsen has called the Basket and Rationale Reset – new priorities shift how and why consumers spend cash while prioritizing what they deem to be essential.

With reports saying that the unemployment rate is expected to jump to 18.5%, industries like tourism & hospitality crippled, and the overall economy forecasted to contract by as much as 7.3% by year-end; it’s unsurprising that the Pinoy eConsumer is reviewing it’s purchasing habits. Looking towards 12.12 and onwards, these consumer behaviors and sentiments online can help shape the distinction from the rest of the competition especially when the concept of value is being re-evaluated. As more adapt to digital, extracting realtime relevant and actionable information and insights has become an imperative for those who want to cut through the noise. Interested in learning more about the nuanced Pinoy eConsumer behaviors? Become a client partner of NUWORKS and get local insights from the NUWORKS Engagement Reports, inquire now by sending an email to pat.saez@nuworks.ph.

Resources:

- NUWORKS Internal Engagement (Social Listening) Reports, September – November 2020

- SYNC Southeast Asia “Digital Consumers of Tomorrow, Here Today” (Survey, conducted online in May 2020) by Facebook and Bain & Company

https://www.facebook.com/business/news/digital-consumers-of-tomorrow-here-today - Digital 2019: The Philippines by Hootsuite

- Nielsen Covid-19 Reset October 2020 Report